Advantages and Disadvantages of Fdi to Home Country

An increase in Foreign investment levels increases the income and employment of the receiving country. Foreign Direct Investment FDI is an investment by an organization from one country to another with the aim of establishing.

What Is Foreign Direct Investment Fdi Fdi Advantages And Disadvantages A Plus Topper

The party making the investment.

. Costs of FDI for Home Country - The home countrys balance of payments can suffer. FDI as defined in Dictionary of Economics Graham Bannock etal is. From the initial capital outflow required to finance the FDI If the purpose of the FDI is to serve the home.

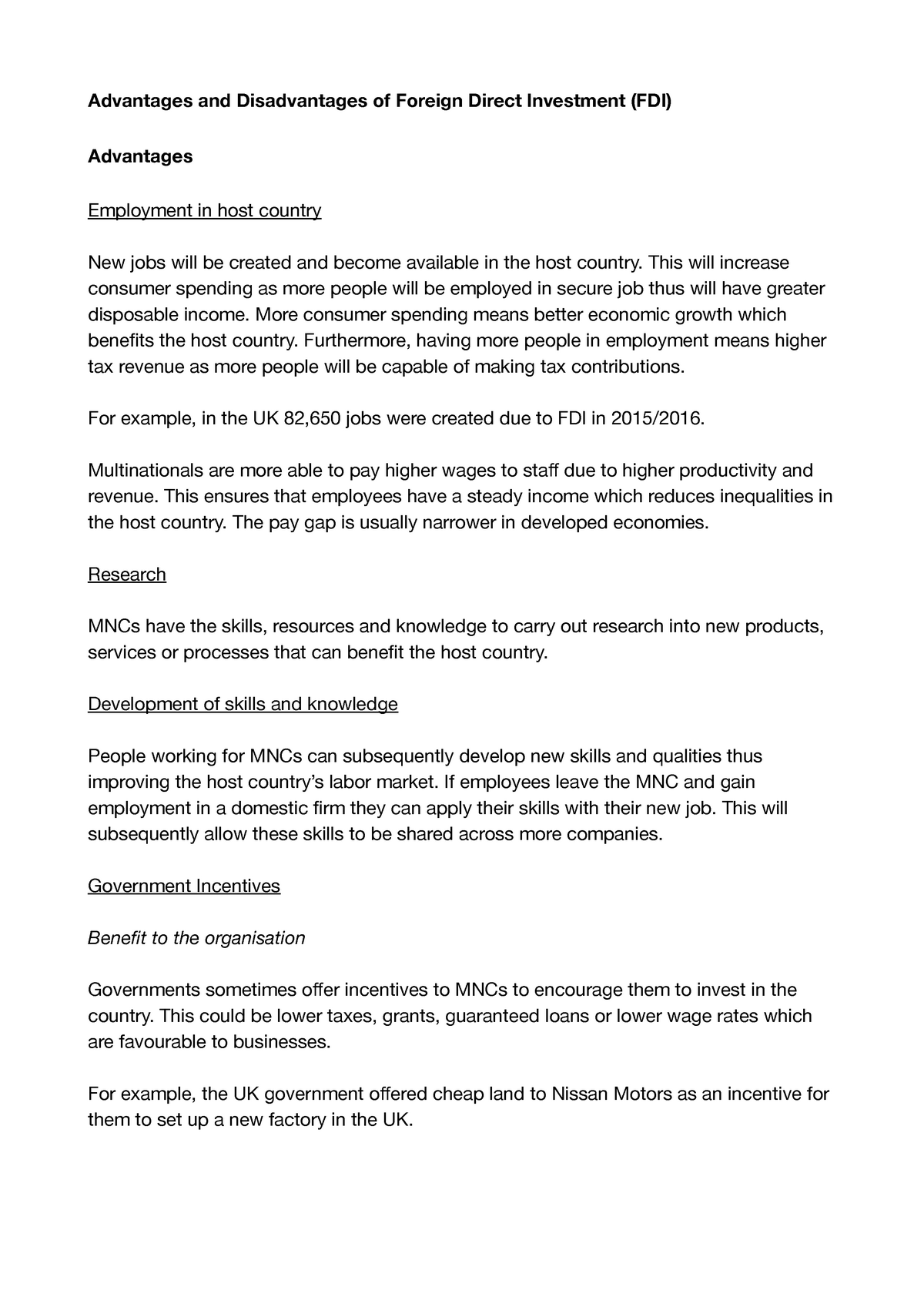

Advantages and disadvantages of FDI to home country. Disadvantages of Foreign Direct Investment FDI Repatriation reinvestment and distribution of profits cannot be controlled by the host country. The benefit of FDI to the host country is that the resources can be transfers which can give a good effect.

FDI is the acronym Foreign Direct Investment. The first is a green-field investment which involves the establishment of a wholly new operation in a foreign country. Investment in the same industry abroad as a firm operates in at home Platform FDI.

Explore the definition the. The most important channel through which foreign capital flows into the country is Foreign Direct Investment FDI. As a result balance of payment of host countries improves.

It is a scheme used when any person or any business holds at least a 10 share of any foreign. Further FDI helps to increase the exports of the developing countries. Advantages of FDI.

TYPES Horizontal FDI. Foreign Direct Investment FDI is better than the external. FDI Foreign Direct Investment simply refers to the act of investing capital in a business enterprise that operates overseas and in a foreign country.

Through foreign direct investment locals can get employment opportunities. What are the disadvantages of foreign direct investment to host countries. A source country into a.

FDI Advantages and Disadvantages. FDI its advantages and disadvantages 1. It helps in the transfer of technology.

Several advantages can be claimed for foreign direct investment FDI. 1 Such investment does not burden the tax payer since no interest at fixed rate is to be paid as in the case of foreign. While FDI or Foreign Direct Investment can be defined as an investment made in a foreign country for business or production purposes FII or Foreign Institutor Investor on the.

The creation of jobs is the most obvious advantage of FDI one of the most important reasons why a nation especially a developing one will look to attract foreign direct. FDI takes on two main forms. The resources can be said that such as capital technological and managerial.

Advantages And Disadvantages Of Foreign Direct Investment Fdi India

Advantages And Disadvantages Of Foreign Direct Investment Research Fdi

Advantages And Disadvantages Of Foreign Direct Investment Fdi Advantages And Disadvantages Of Studocu

What Is Foreign Direct Investment Fdi Fdi Advantages And Disadvantages A Plus Topper

0 Response to "Advantages and Disadvantages of Fdi to Home Country"

Post a Comment